Effective 1 January 2023, participants can restore prior contributory service in the case of deferred retirement benefits, under certain conditions. You will find below information on this type of restoration and how to make the request, should you be interested.

What is a deferred retirement benefit?

A deferred retirement benefit is a periodic benefit option available to participants who have five or more years of contributory service and who separate before reaching their normal retirement age. A participant who elects a deferred retirement benefit will receive a periodic benefit, which can be put into payment at any time between their early retirement age and their normal retirement age. Click here to learn more about the deferred retirement benefit.

What is restoration of a deferred retirement benefit under Article 24 bis?

Effective 1 January 2023, the United Nations General Assembly approved an amendment to Article 1 of the Fund’s Regulations and a new provision, Article 24 bis. This change allows the restoration of prior contributory service on a cost-neutral basis for the Fund in the case of participants who had previously elected, or were deemed to have elected, a deferred retirement benefit (a pension option instated by Article 30) that is not yet in payment.

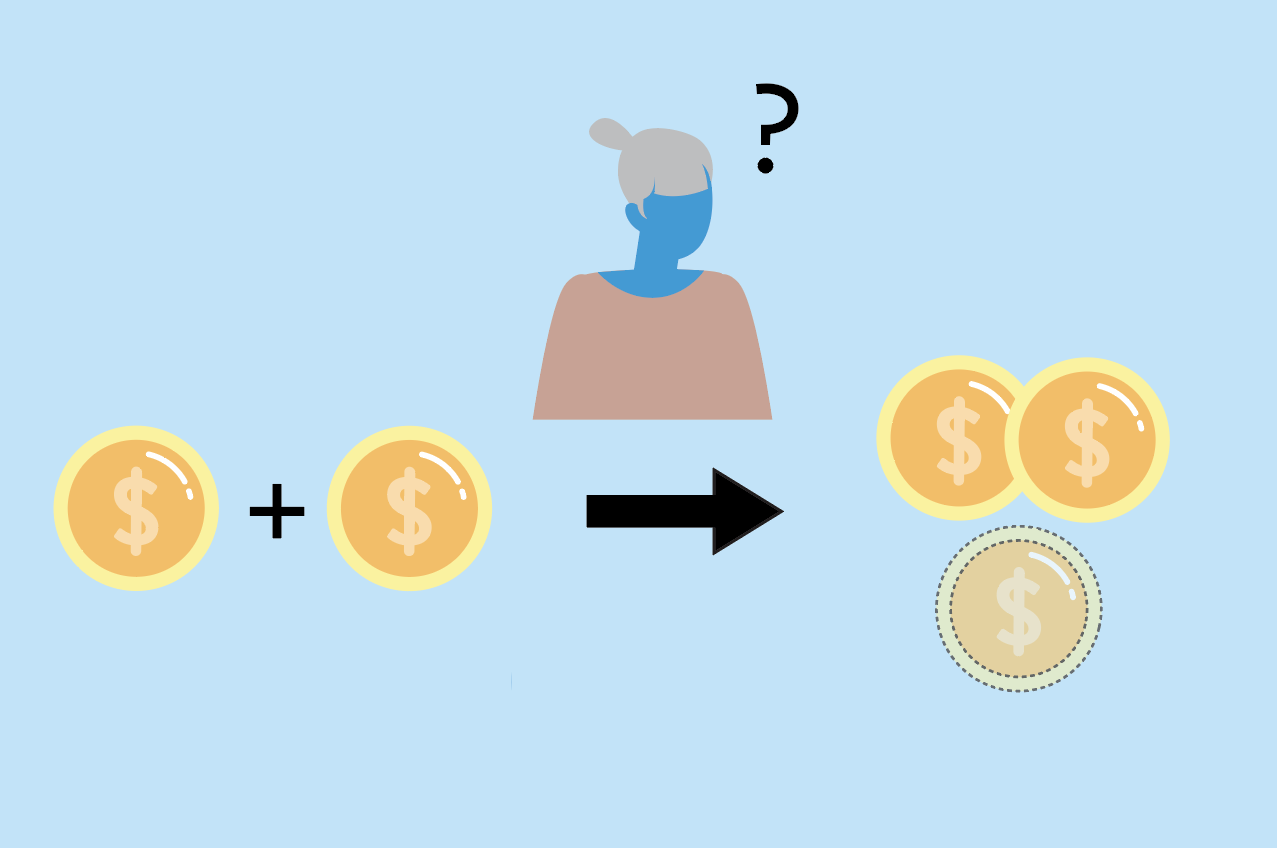

Under Article 24 bis, the amount of the contributory service credited to the current participation is calculated by converting the actuarial value of the deferred retirement benefit not yet in payment into an equivalent length of contributory service based on the current pensionable remuneration rates. This calculation is designed to ensure that the restoration is undertaken in such a way that it is not expected to cost the Fund. This will usually result in the number of years “purchased” being less than the actual contributory service originally accrued. This is due to the later participation usually having a higher pensionable remuneration than earlier periods of service.

When must the election be made?

An election to restore a deferred retirement benefit under Article 24 bis must be made within one year of re-commencement of participation. For active participants who were already in service on 1 January 2023, the election must be made by 31 December 2023.

What are the key principles that apply to the Article 24 bis restoration option?

As per the Pension Board’s guidance provided at its 18-19 April 2023 session (see here), the following principles shall apply to this new restoration option. Firstly, the eligibility to receive a periodic benefit is preserved on restoration, even if the calculated contributory service after restoration is less than five years. Secondly, the entitlement to a divorced surviving spouse’s benefit is unchanged on restoration. Thirdly, the contributory service purchased after restoration shall not exceed the contributory service for which the deferred retirement benefit was elected. Finally, a participant cannot revert to the original deferred retirement benefit after an election to restore.

How is restoration under Article 24 bis different from restoration under Article 24 of the Regulations?

Restoration allows eligible former participants who re-enter the Fund to elect to add their prior contributory service to their current participation. By restoring, participants combine all or part of their prior period of contributory service with their current one; joining contributory service periods from restoration may increase their future pension.

Under Article 24, restoration is only possible for former participants who took a withdrawal settlement upon separation, or who had elected a deferred retirement benefit prior to 1 April 2007. This restoration option and related conditions are still in force and have not been affected by the above-mentioned change. Under Article 24, the full length of the prior contributory service is added to the current participation.

Under Article 24 bis, restoration has been extended to participants who elected or were deemed to have elected a deferred retirement benefit after 1 April 2007. Such participants were previously precluded from restoration under Article 24. Due to the fact that restoration under Article 24 bis must be cost-neutral to the Fund, the amount of contributory service added to the current participation in such cases will usually be lower than the actual length of the prior contributory service.

This is not the same as restoring under the long-standing arrangements of Article 24. Participants will need to consider carefully whether restoring under Article 24 bis is likely to lead to a better outcome than simply keeping their original entitlements separate. This will depend on the participants’ individual circumstances, although analysis by the Fund has found that very few participants are expected to benefit from restoring under Article 24 bis.

Click here to learn more about restoration.

How do I request restoration of prior contributory service in the case of a deferred retirement benefit (Article 24 bis)?

To make a request for restoration of a deferred retirement benefit under Article 24 bis, you should submit your application using the official UNJSPF forms.

Form C.8 should be submitted first and must be submitted within the time frame allowed. This form allows participants considering this restoration to express their interest and get an estimate of the impact of the restoration on their pension rights. This form (PENS.C/8 EN) is available here with the related instructions.

For participants who were already in service as of 1 January 2023, the form expressing interest must be submitted by 31 December 2023. For participants who re-entered the Fund after 1 January 2023, the form must be submitted within one year of re-entry. Upon receipt of this form, the Fund will determine the participant’s eligibility to avail of restoration under article 24 bis. If confirmed, the related estimates will be generated and provided to the applicant, together with instructions on the next steps in the process.

If, based on the estimate, the participant decides to proceed with a formal request of restoration, they must submit a second, C.9 (FINAL CONSENT FORM PENS.C/9 EN) to the Fund, within sixty days of receipt of the estimate. This form will be sent directly by the Fund to participants who have confirmed they want to elect restoration, following the process above described.

Participants staff of UN Family organizations should submit their restoration forms to the Fund either electronically, by uploading them inside their UNJSPF Member Self Service (MSS) portal under the “Document Upload” tab, or by mail (pouch or regular mail) or drop them off in person. The Fund’s contact details are provided on our website, here: https://contact.unjspf.org/.

Participants staff of other member organizations should submit their restoration forms and related queries to their Staff Pension Committee secretariat.